-

PROVIDERS

Register now

Are you getting the full picture? A webinar series on the power of comprehensive intelligent diagnostics

-

LIFE SCIENCES

Enroll now

Tempus’ Patient-Derived Organoid ScreensEvaluate the efficacy of your preclinical compounds using fixed organoid panels designed for diverse therapeutic applications. Space is limited — enroll by June 30, 2025, to secure your spot.

-

PATIENTS

It's About Time

View the Tempus vision.

- RESOURCES

-

ABOUT US

View Job Postings

We’re looking for people who can change the world.

- INVESTORS

02/20/2025

Oncology innovation: How emerging biotechs lead through RWD & AI

Ryan Fukushima, Chief Operating Officer at Tempus, discusses how cutting-edge tools are helping biotechs streamline clinical trials, optimize patient selection, and improve decision-making, even amidst challenging market conditions.

Authors

Ryan Fukushima

Chief Operating Officer, Tempus

Chief Operating Officer, Tempus

In an evolving biotech landscape, emerging companies are harnessing the power of real-world data (RWD) and artificial intelligence (AI) to help accelerate oncology drug development. Discover how biotechs are leading the next wave of oncology innovation

The evolving biotech landscape

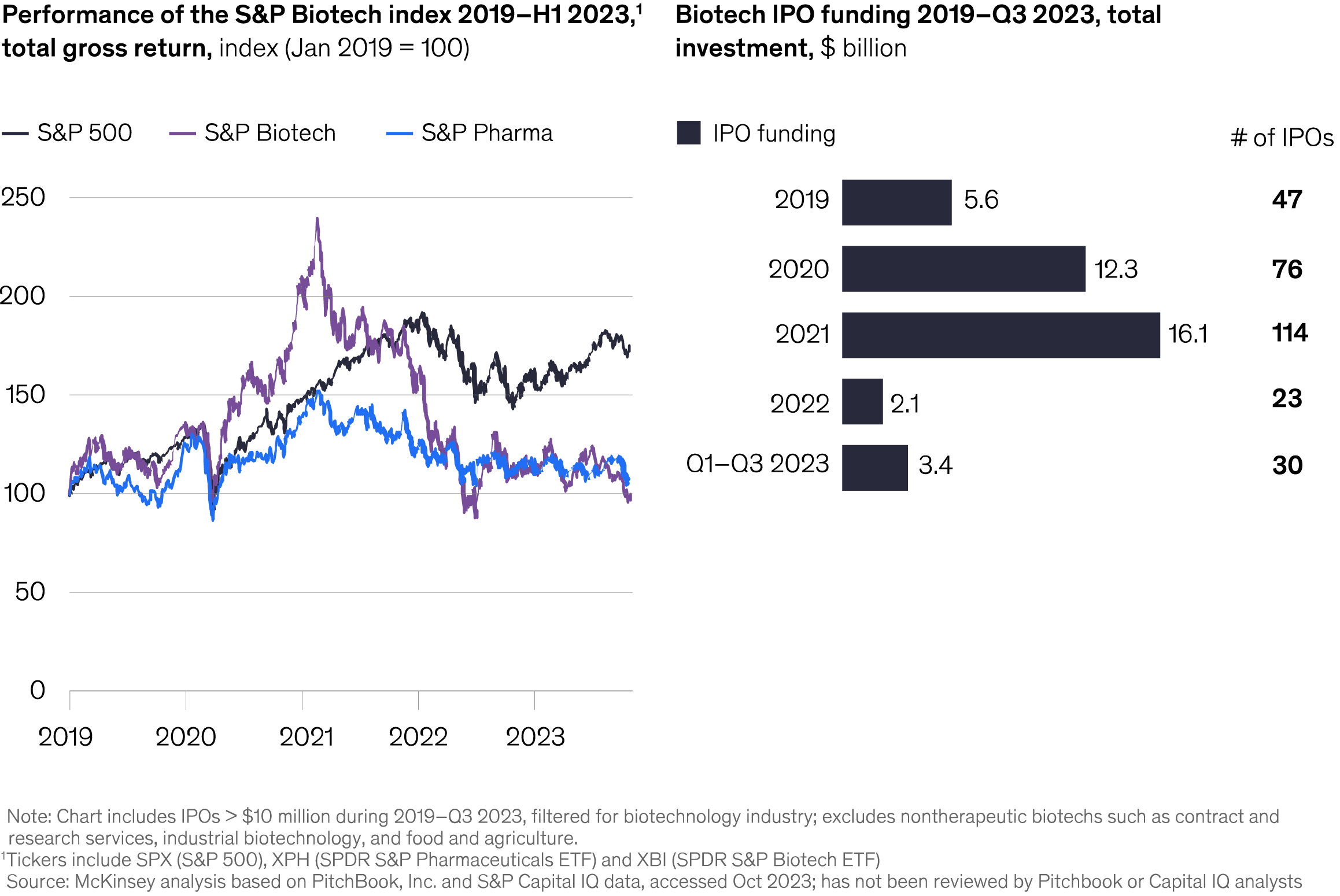

The lengthy process of developing and bringing drugs to market heightens these challenges. On average, it takes about seven years from investigational new drug to new drug application approval for anti-cancer drugs and a significant financial investment, accounting for the numerous failures along the way.2 These smaller companies often concentrate their limited resources on just one or two critical trials, which creates a concentrated impact of any setbacks. Figure 1 S&P biotech index and IPO funding1

Figure 2 First-in-class oncology drug originators, 2010-20204

Despite the challenging macro environment and daunting obstacles, biotechs continue to lead in FDA drug approvals. Over the past decade, approximately 50% of the 50 FDA-approved oncology drugs originated from biotechs, demonstrating their propensity for successful innovation.5 However, there is a pressing need to address inefficiencies and support biotech development to help facilitate bringing life-saving medicines to the market. Tempus’ strategic approach to powering discovery and development

One of the first questions we ask revolves around whether each asset has prioritized the optimal indications for development. This strategy can be crucial when designing Phase I trials, such as choosing an all-comers or a multi-tumor type approach and narrowing down options for Phase II trials to reduce the trial size to preserve precious resources. As clinical stage development progresses, refining not just the indication but also the inclusion and exclusion (I/E) criteria in the protocol becomes critical. Rather than making decisions based on conventional wisdom or key opinion leaders’ advice, real-world contemporaneous data could be used to support biotechs to make informed trade-off decisions about potentially diluting the efficacy signal or mitigating potential recruitment challenges. Another critical aspect of clinical trial optimization is determining the combination partners to pursue during Phase I or Phase II trials, which may be facilitated through leveraging standard-of-care (SoC) treatments reflected in real-world datasets. Lastly, endpoint optimization is a final consideration. This involves selecting endpoints that are not only practical but may also compress the study duration. While overall survival is a common endpoint for Phase III studies, we can use real world data to uncover other primary endpoints based on current outcomes on standard of care treatments. With advancements in minimal residual disease (MRD) detection and the availability of RWD, it’s possible to contextualize endpoints to accelerate comparative analyses. Data-driven decision making

Once these subpopulations are established, Tempus works collaboratively to analyze the current SoC treatments and outcomes as reflected in the real-world data. This sets the stage for simulations that may help predict the potential impacts of novel treatments on these mechanisms, offering a glimpse into potential future states post-drug approval. There are a spectrum of possibilities, and modeling out these efficacy signals can be an effective way to help make informed go/no-go decisions during Phase II and beyond. The overarching goal is to help biotechs enhance the efficiency of their clinical trials, and the industry is beginning to see the fruits of these efforts. By incorporating RWD analysis from the protocol design phase through to the contextualization of results, it is possible to reduce both the number of patients needed for Phase II trials and the number of sites required to run these studies.6 These are significant cost drivers in clinical trials, and for biotechs with limited budgets, it is crucial to maximize the value of every dollar spent. Tempus is at the forefront of leveraging RWD, collaborating with leading companies to not only help inform trial design but also provide insights on how to contextualize trial results against SoC, particularly when a control arm is not used in a Phase II trial. RWD in action

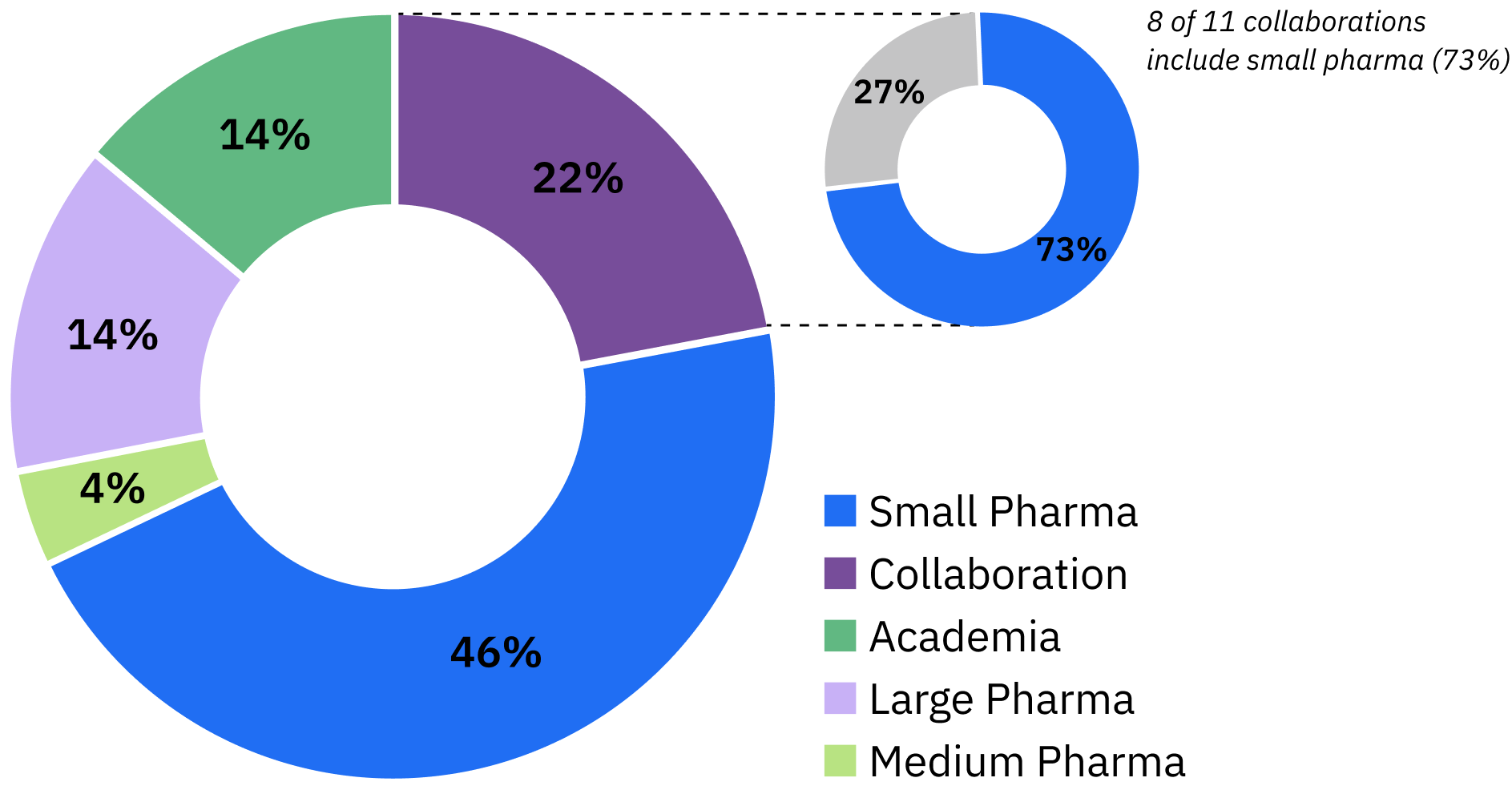

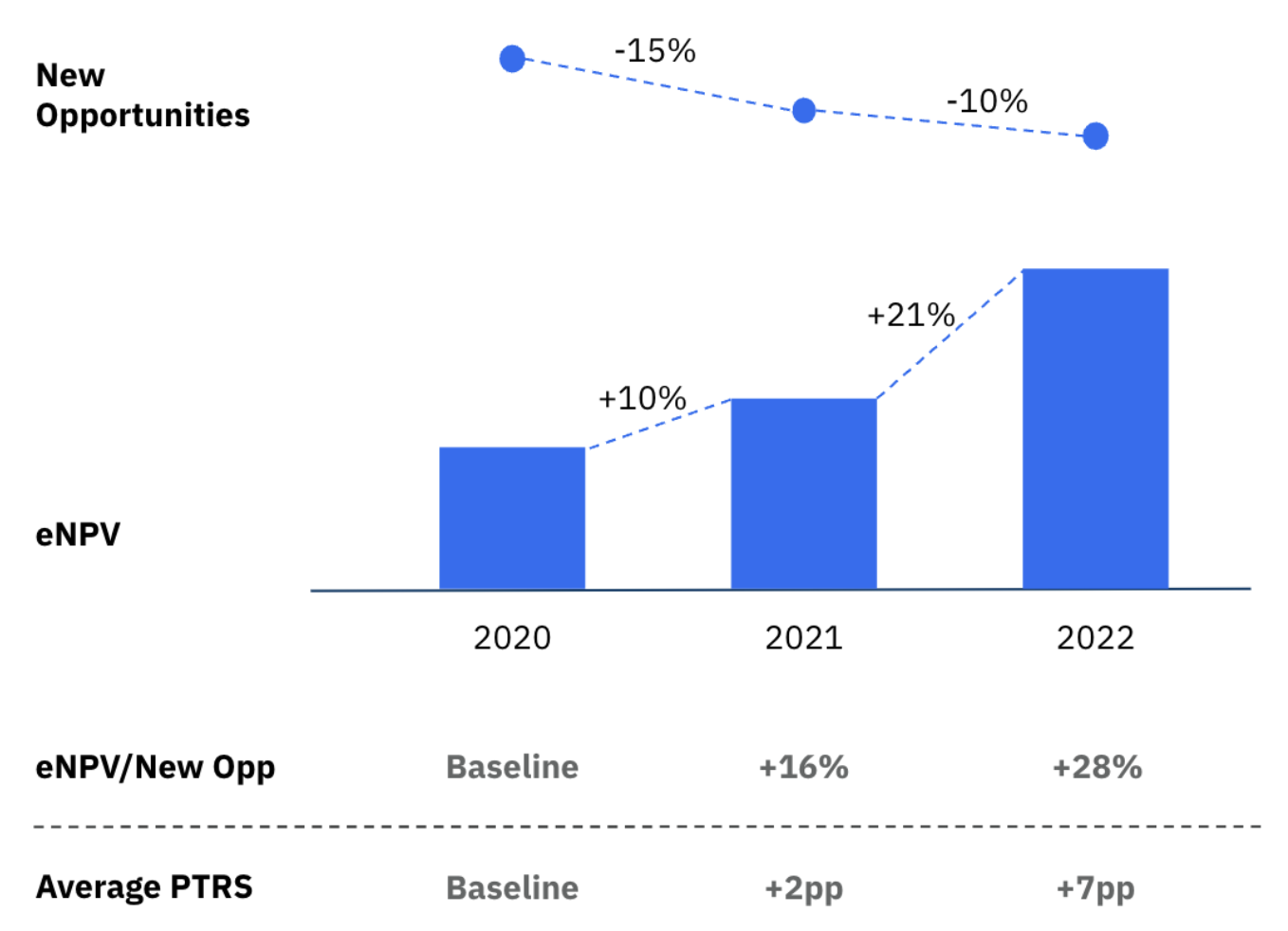

By leveraging our multimodal data library, we perform in-depth analyses and equip our partners with the insights needed to quickly make informed development decisions. Typically, we see an increase in PTRS by about two percentage points in our first year of engagement and grows to 7% lift by the second year of engagement.5 This process allows for a deeper focus on investments in clinical development, targeting smaller opportunities and ruling out less promising studies based on RWD insights. Figure 3 Increasing PTRS with AI and RWD5

Mirati’s KRYSTAL-1 study, which focused on KRAS G12C mutant patients, is a prime example of applying RWD to trial design. The study was a single-arm trial without a control group, raising questions about how the results from the interventional arm compared to SoC. Although initial data from Dana Farber provided some stratification for PD-L1 high or positive patients, the patient counts were low, limiting the strength of the conclusions.8 Fortunately, a propensity-matched analysis could be conducted against the entire I/E criteria of the KRYSTAL-1 study. This analysis revealed differences in outcomes between patients with KRAS G12 wild type and those with KRAS G12C mutation when PD-L1 or tumor proportion score (TPS) was less than or equal to 50%.6 Presenting this larger dataset as supplementary information to regulators supported the argument that these patients have poorer outcomes than previously reported, making the study results even more compelling. This is crucial for investment decisions, particularly for a Phase II trial approaching a critical go/no-go decision for advancing to Phase III. Embedding our Data Products with our CRO solutions

Tempus is excited to introduce a new offering tailored for biotechs, integrating RWD, AI expertise, and Contract Research Organization (CRO) services that will bring end-to-end support to critical clinical development studies. We call it the Tempus Biotech Program. With a full-service CRO, Tempus Compass, we can now embed our capabilities throughout clinical development to leverage data and help transform it into insights, covering trial design, feasibility, site selection, and study execution all powered by a multimodal dataset. The goal is for Tempus to act as an extension of a biotech’s team, designing clinical development strategies in tandem and applying insights at each step of the process. This partnership model goes beyond project-based collaborations, offering a comprehensive solution to biotechs. We have already seen some key wins with this approach. For instance, in collaboration with Sermonix, we utilized data-driven strategies to optimize recruitment. By focusing on top-tier academic medical centers and employing a rapid, just-in-time site activation approach, we enabled multiple avenues for patient recruitment, particularly for populations like ESR1-positive breast cancer patients. This method has significantly reduced startup time, saving an estimated 10 months in enrollment based on the initial trial projections.10 This type of acceleration is game-changing for biotechs where every month counts. Most importantly, the Tempus Biotech Program is not just about bundling capabilities. What’s crucial for biotechs, particularly when cash is a constrained resource due to the current macro environment, is offering this in a shared-risk manner. We’re providing a holistic service paired with an economic model that’s designed to be more productive and conducive. We’re excited to partner with the next set of innovators, and the Tempus Biotech Program is our commitment to accelerating precision medicine for all. To learn more about how Tempus Compass can tailor solutions to your biotech’s unique challenges, click here. |

1. Capra E, Fougner C, Mäkitie A, Leclerc O, Suberski A, Suhendra M. What early-stage investing reveals about Biotech Innovation. McKinsey & Company. December 12, 2023. Accessed September 19, 2024.

2. Shuhang Wang, Qiuyan Yang, Lan Deng, Qi Lei, Yuqi Yang, Peiwen Ma, Yuxin Men, Bryant C. Yung, Robert J. Lee, Mengzi Zhang, Ning Li, An overview of cancer drugs approved through expedited approval programs and orphan medicine designation globally between 2011 and 2020, Drug Discovery Today, Volume 27, Issue 5, 2022, Pages 1236-1250, ISSN 1359-6446, https://doi.org/10.1016/j.drudis.2021.12.021.

3. Sertkaya A, Beleche T, Jessup A, Sommers BD. Costs of Drug Development and Research and Development Intensity in the US, 2000-2018. JAMA Netw Open. 2024;7(6):e2415445. doi:10.1001/jamanetworkopen.2024.15445

4. Fogel DB. Factors associated with clinical trials that fail and opportunities for improving the likelihood of success: A review. Contemp Clin Trials Commun. 2018 Aug 7;11:156-164. doi: 10.1016/j.conctc.2018.08.001. PMID: 30112460; PMCID: PMC6092479.

5. Kate H. Kennedy, Krisstel Gomez, Natalie J. Thovmasian, Dennis C. Chang, Small biotechs versus large pharma: Who drives first-in-class innovation in oncology?, Drug Discovery Today, Volume 28, Issue 2, 2023, 103456, ISSN 1359-6446, https://doi.org/10.1016/j.drudis.2022.103456.

6. Anagnostopoulos C, Champagne D, Devereson A, Devenyns T, Tarkkila H. How artificial intelligence can power clinical development. McKinsey & Company. November 22, 2023. Accessed September 19, 2024.

7. *Results based on 30+ analyses from Tempus to increase probability of technical and regulatory success(PTRS) across multiple strategic partners (Tempus Strategic Partners: +$100m over 3-5 yrs).

8. Slides 22-23 Mirati ESMO Investor Event

9. Based on publicly available 2022 segment revenue

10. Blau M.D., Sibel. Operational Metrics for the ELAINE 2 Study Combining a Traditional Approach with a Just-in-TIME Model. ASCO 2022.

-

04/02/2025

Development of a clinical algorithm to prognosticate response to immunotherapy

Discover how Tempus developed and deployed the Immune Profile Score (IPS)—a powerful algorithm that provides prognostic insights into patient outcomes following treatment with immune checkpoint inhibitors (ICIs)—in ~18 months. This case study highlights the AI-driven methodology, real-world validation, and the impact of IPS in precision oncology.

Read more -

03/25/2025

AI & ML in action: Unlocking RWD with GenAI through Tempus Lens

Discover how Tempus is equipping researchers with innovative AI solutions to fully leverage the potential of multimodal data. Gain insights from a panel of leaders across healthcare and life sciences as they discuss the impact of these advanced tools on delivering insights with speed.

Watch replay

Secure your recording now. -

03/11/2025

Case Report: Pharmacogenomic testing and mood stabilizers

This real-world case demonstrates how the Tempus nP pharmacogenomic test facilitated a personalized treatment approach for a patient with bipolar disorder.

Read more